how much taxes are taken out of a paycheck in ky

Heres how to complete the steps that apply to your situation. So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck.

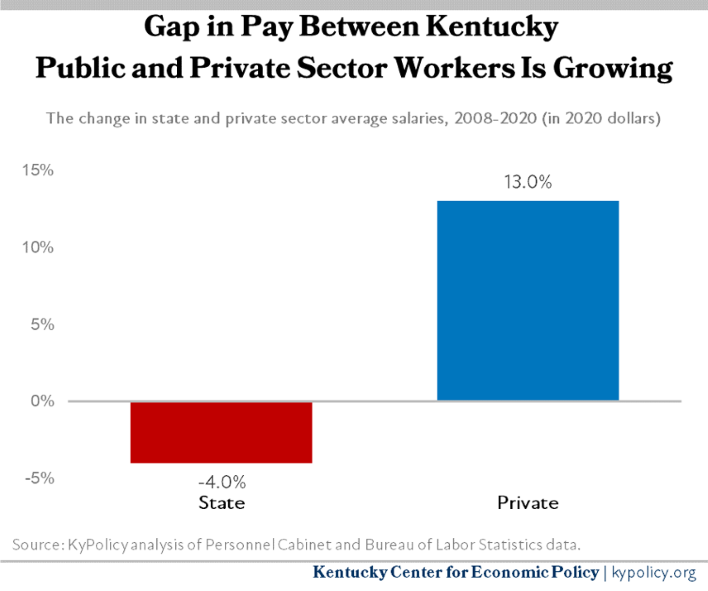

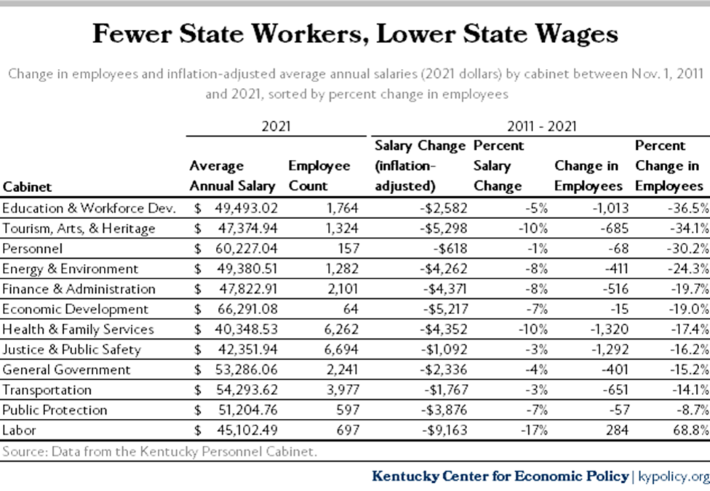

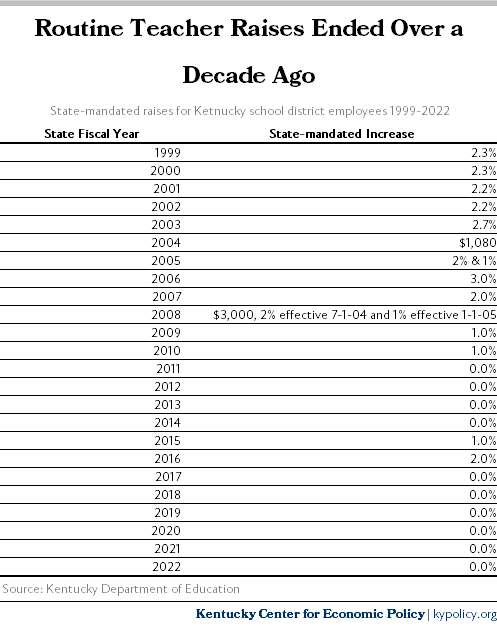

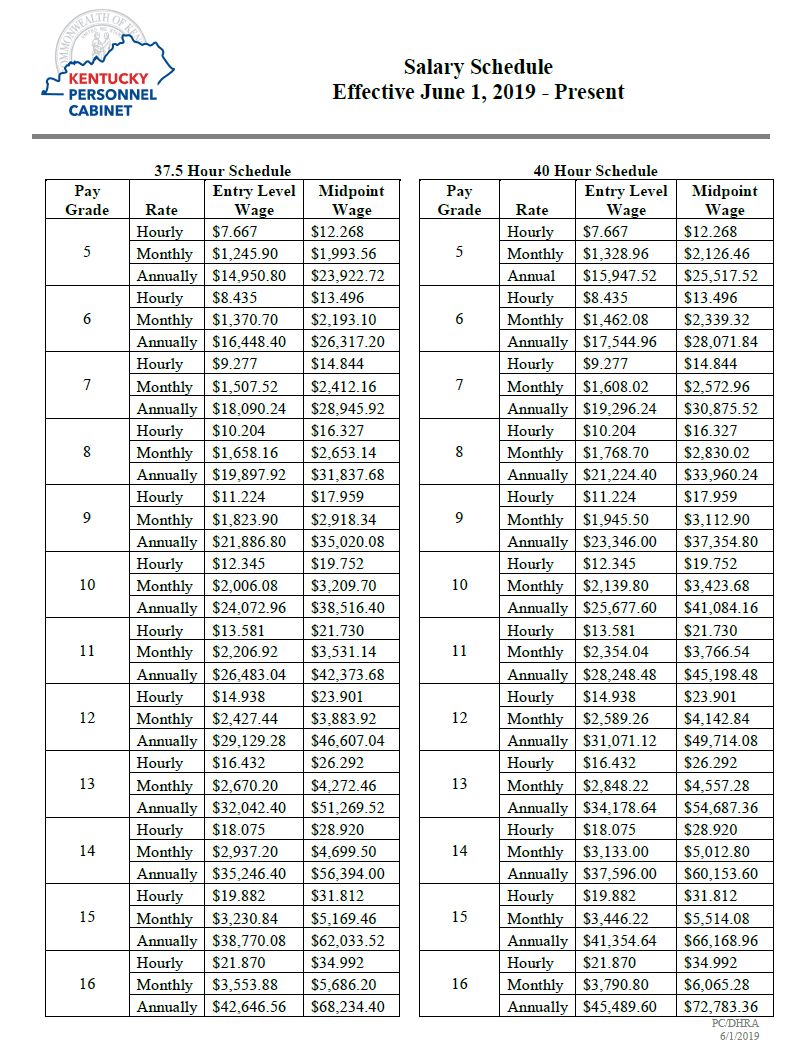

A Decade Without Raises And Weakened Benefits Have Created A State Workforce Crisis Addressing It Adequately Should Be A Top Priority In The New Budget Kentucky Center For Economic Policy

For instance a worker who earns 30000 a year at one job would have the full 58 percent tax taken out of his paycheck.

. For 2022 the limit for 401 k plans is 20500. Federal income taxes are paid in tiers. The wage base is 11100 for 2022 and rates range from 05 to 95.

This calculator is intended for use by US. If youre a new employer youll pay a flat rate of 27. For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax.

The average taxpayer gets a tax refund of about 2800 every year. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. How much tax is taken out of a 200 paycheck in Kentucky please let me know thanks.

Speak with a KPPA counselor on the phone. Residents only need to pay federal tax. I paid state taxes on the W-2 from Kentucky.

So there you have it. But if not if all his work is done in TN then there is no reason to withhold KY taxes. The only way he would have to pay KY taxes is if he physically goes to KY and does work.

These are contributions that you make before any taxes are withheld from your paycheck. Log in to Self Service. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay.

How much do you make after taxes in Texas. A 2020 or later W4 is required for all new employees. Its important to note that there are limits to the pre-tax contribution amounts.

If he frequently goes back and forth between the two states it makes sense to withhold KY taxes. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Remember paying your SUI in full and on time qualifies you to get a whopping 90 off of your FUTA tax bill so make sure you pay attention to the due dates.

Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck. I filed a Ky tax return and indicates I owe almost 4000. States taxes basically come down to two factors.

Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566. Kentucky Salary Paycheck Calculator. Both employers and employees are responsible for payroll taxes.

103 KAR 18150 To register and file online please visit wrapskygov. Complete and file a Form 2040. I filed an Ohio tax return and I am getting a refund.

Effective May 5 2020 Kentuckys tax law requires employers filing on a twice monthly and monthly frequency to electronically file and pay the income tax withheld for periods beginning on or after January 1 2021. Kentucky residents who work a full-time and a part-time job may want to provide each employer with information about their total annual earnings so those employers can deduct the proper amount of taxes from each paycheck. This is because they have too much tax withheld from their paychecks.

The calculation is based on the 2022 tax brackets and the new W-4 which in 2020 has had its first major. Calculate your Kentucky net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Kentucky paycheck calculator. Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare.

Income amounts over 9950 19900. I thought that would go to Ohio. For those age 50 or older the limit is 27000 allowing for 6500 in catch-up contributions.

This article is part of a larger series on How to Do Payroll. You are able to use our Kentucky State Tax Calculator to calculate your total tax costs in the tax year 202122. For a single filer who earns 59000 per annual the total take home pay is 48519.

Enter your name address Social Security number and tax. Form W-4 is available on the IRS website. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b.

Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. Published January 21 2022. Posted by 5 years ago.

Our calculator has been specially developed in order to provide the users of the calculator with not only. This Kentucky hourly paycheck calculator is perfect for those who are paid on an hourly basis. It can also be used to help fill steps 3 and 4 of a W-4 form.

These are the federal tax brackets for the taxes youll file in 2022 on the money you made in 2021. Unless youre in construction then your rate is 10. Contact our office toll free at 1-800-928-4646 or locally at 502-696-8800.

You can easily update your address on our Self Service website. For the employee above with 1500 in weekly pay the calculation is 1500 x 765 0765 for a total of 11475. I am confused since I thought I wouldnt owe Ky taxes if I lived in Ohio all year.

How much tax is taken out of a 200 paycheck in Kentucky please let me know thanks. Under Americas progressive tax system chunks of your income are taxed at different rates. Kentucky Hourly Paycheck Calculator.

Switch to Kentucky hourly calculator. Income amounts up to 9950 singles 19900 married couples filing jointly. For a single filer the first 9875 you earn is taxed at 10.

Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare 145 each plus an additional 09 withheld from the wages of an individual paid. The next 30249 you earn--the amount from 9876 to 40125-. In effect taxpayers who get refunds are giving the IRS an interest-free loan of their money.

W4 Employee Withholding Certificate The IRS has changed the withholding rules effective January 2020. Complete a Form 2040 Change of Address Notification and file it with KPPA.

Taxidermist Salary In Louisville Ky Comparably

Ltr Notarized Or Stamped Love Quotes For Him Romantic Lettering Love Quotes For Him

The Tampon Tax Explained Tampon Tax Pink Tax Tampons

Ky General Assembly Makes Expenses Paid With Ppp Loans Deductible

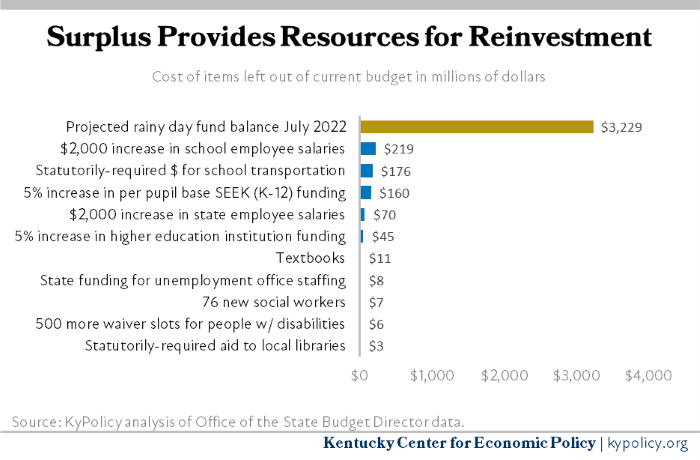

Unprecedented Surplus Presents Opportunity To Both Reinvest In Kentucky S Budget And Build Rainy Day Fund Kentucky Center For Economic Policy

Kentucky Wage Calculator Minimum Wage Org

Yes You Re In The Right Place If You Need Any Fake Docs Passports Id Cards And Lots More To Get The Ad State Farm Insurance State Farm Home Insurance Quotes

The Kentucky Income Tax Rate Is 5 Learn How Much You Will Pay On Your Earnings

Kentucky Paycheck Calculator Smartasset

How To Pay Less Taxes Legally In 2021 Financial Motivation Investing Money Personal Finance Bloggers

Monthly Budget Planner Printable Monthly Budget Printable Etsy Nederland Maandelijkse Budgetplanner Budget Werkbladen Budget Planner

8 Sample Payroll Checks Simple Salary Slip Payroll Checks Quickbooks Payroll Payroll Template

A Decade Without Raises And Weakened Benefits Have Created A State Workforce Crisis Addressing It Adequately Should Be A Top Priority In The New Budget Kentucky Center For Economic Policy

A Decade Without Raises And Weakened Benefits Have Created A State Workforce Crisis Addressing It Adequately Should Be A Top Priority In The New Budget Kentucky Center For Economic Policy

Monthly Yearly Budget Spreadsheets Excel Budget Spreadsheet Budget Spreadsheet Excel Budget

State Of Kentucky Payroll Calendar 2022 Payroll Calendar

Paycheck Calculator Kentucky Ky Hourly Salary

Kentucky Eliminates Composite Returns For Nonresident Individuals Cincinnati Ohio Cpas Advisors